Investing with an advisor: making the shift from DIY

Retire

Key Takeaways:

- A financial advisor can create a financial plan customized to your needs, with guidance on topics such as paying off debt or asset protection.

- Life milestones may spur people to seek professional financial advice, such as sending children to college, buying a second home, or receiving an inheritance.

- Fee structures for working with financial advisors vary. Some may charge based on assets under management, while others might have an hourly or annual rate.

- A financial advisor is a trusted source who can give you impartial information when it comes to money questions.

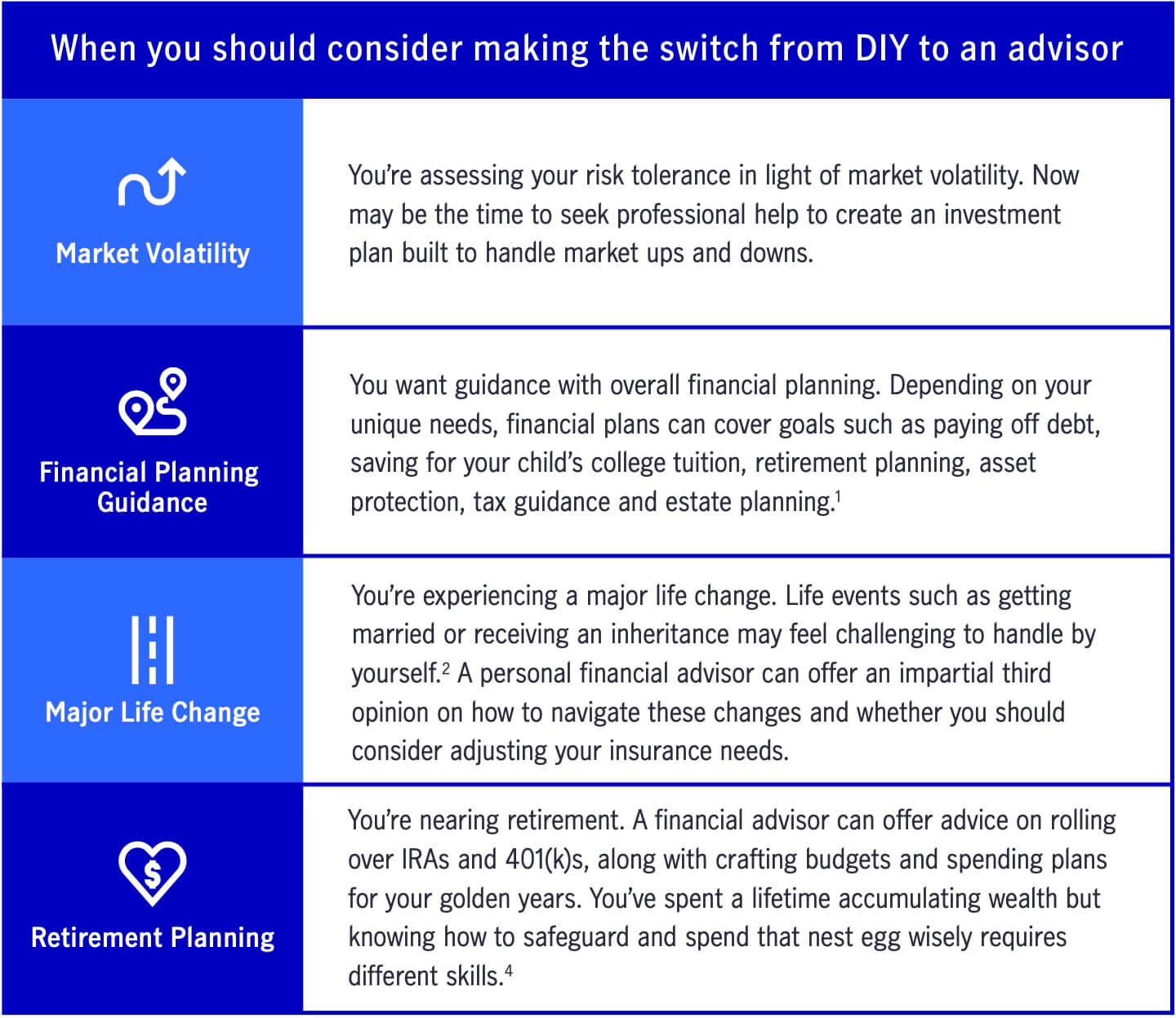

It’s natural for any period of change or market swings to inspire a rethink of your investing approach. Navigating fluctuations as a DIY investor can be empowering, but also challenging and the idea of professional guidance is likely reassuring. Making the decision to see a financial advisor is a personal one based on your own goals, situation and needs. Here are some considerations to help you determine if shifting from a DIY approach to investing with a financial advisor is right for you.

How to find an advisor who fits your needs

The process of switching to an advisor starts with asking questions. Ask about the services they provide, their investment philosophy, how they will measure and evaluate your investments’ performance and how they will work with you.5 They will, in turn, ask you questions about your financial goals and needs, and answer any other questions you have.6

Before meeting with an advisor, collect all of your financial records including investment statements, debt statements, income statements, your most recent tax return and monthly budget so your advisor can get a holistic picture of your financial standing.7

Different types of advisors charge different fees

In your meeting with the advisor, ask how they get paid and the all-in costs, which include their fee structure and fees for the investments.8 These fees will range. Some financial advisors charge by assets under management, which can cost about 1% for an in-person financial advisor, depending on the size of the account.9 A John Hancock advisor may charge an hourly fee of $200 or may elect to charge a flat fee based on your financial planning needs.

Overall benefits of working with an advisor

For DIY investors, it can be easy to get emotional after big market swings, and an advisor is a trusted source to remind you to stay the course and focus on the long-term. Beyond investing advice, John Hancock financial advisors can offer money guidance for all life stages and are experts at crafting plans that allow you to live your best life today while preparing for the future. For further tips and financial advice about how to make the switch to an advisor, connect with a John Hancock expert today.

Citations:

1 MarketWatch: “Opinion: This DIY Investor Says There Are 5 Good Reasons to Hire a Financial Adviser” by Chris Mamula, July 3, 2018 https://www.marketwatch.com/story/this-diy-investor-says-there-are-5-good-reasons-to-hire-a-financial-adviser-2018-06-19

2 U.S. News & World Report: “10 Life Events That Require Financial Planning” by U.S. News Staff, July 21, 2015 https://money.usnews.com/money/personal-finance/articles/2015/07/21/10-life-events-that-require-financial-planning

3 Money Under 30: “When Is It Time to Hire a Financial Advisor” by David Weliver, Dec. 16, 2020 https://www.moneyunder30.com/when-is-it-time-to-hire-a-financial-advisor

4 Barron’s; “Getting Ready to Retire? Here’s a Planning Guide for the 5 Years Before Your Last Day.” by Debbie Carlson, Jan. 2, 2020 https://www.barrons.com/articles/getting-ready-to-retire-heres-a-planning-guide-for-the-5-years-before-your-last-day-51577979901

5 Dave Ramsey: “How to Prepare for a Meeting with a Financial Planner” by Chris Hogan, Nov. 16, 2020 https://www.daveramsey.com/blog/how-to-prepare-meeting-financial-planner

6 Nerdwallet: “10 Questions to Ask a Financial Advisor” by Andrea Coombes, Nov. 20, 2020 https://www.nerdwallet.com/article/investing/10-questions-ask-financial-advisor

7 Dave Ramsey: “How to Prepare for a Meeting with a Financial Planner” by Chris Hogan, Nov. 16, 2020 https://www.daveramsey.com/blog/how-to-prepare-meeting-financial-planner

8 Investopedia: “The Smart Way to Switch Financial Advisors” by Amy Bell, Jan. 28, 2020 https://www.investopedia.com/articles/financial-advisor/012117/smart-way-switch-financial-advisors.asp

9 Nerdwallet: “How to Choose a Financial Advisor” by Andrea Coombes and Alana Benson, Jan. 7, 2021 https://www.nerdwallet.com/article/investing/how-to-choose-a-financial-advisor

Financial planning and investment advice provided by John Hancock Personal Financial Services, LLC (“JHPFS”), an SEC registered investment adviser. Investments: not FDIC insured – No Bank Guarantee – May Lose Value. Investing involves risk, including loss of principal, and past performance does not guarantee future results. Diversified portfolios and asset allocation do not guarantee profit or protect against loss. Nothing on this site should be construed to be an offer, solicitation of an offer, or recommendation to buy or sell any security. Before investing, consider your investment objectives and JHPFS’s fees. JHPFS does not provide legal or tax advice and investors should consult with their personal legal and tax advisors prior to purchasing a financial plan or making any investment.