Reassessing life insurance:

What every 50 year-old needs to know

INSURE

Congratulations! The kids are out (or nearly out) of college. Soon, you’ll be empty nesters and can start thinking about what you’d like to do for you. Without tuition to worry about you can focus on paying off the house and building up retirement savings. It’s also a really good time to take a look at your life insurance needs.

For one thing, you want to make certain your beneficiary information is up to date. And while you’re at it, recalculate your coverage needs, too. Around age 50, many people are tempted to scale back on their coverage. But before you make any drastic changes, read on…

Facing the facts that could impact your future.

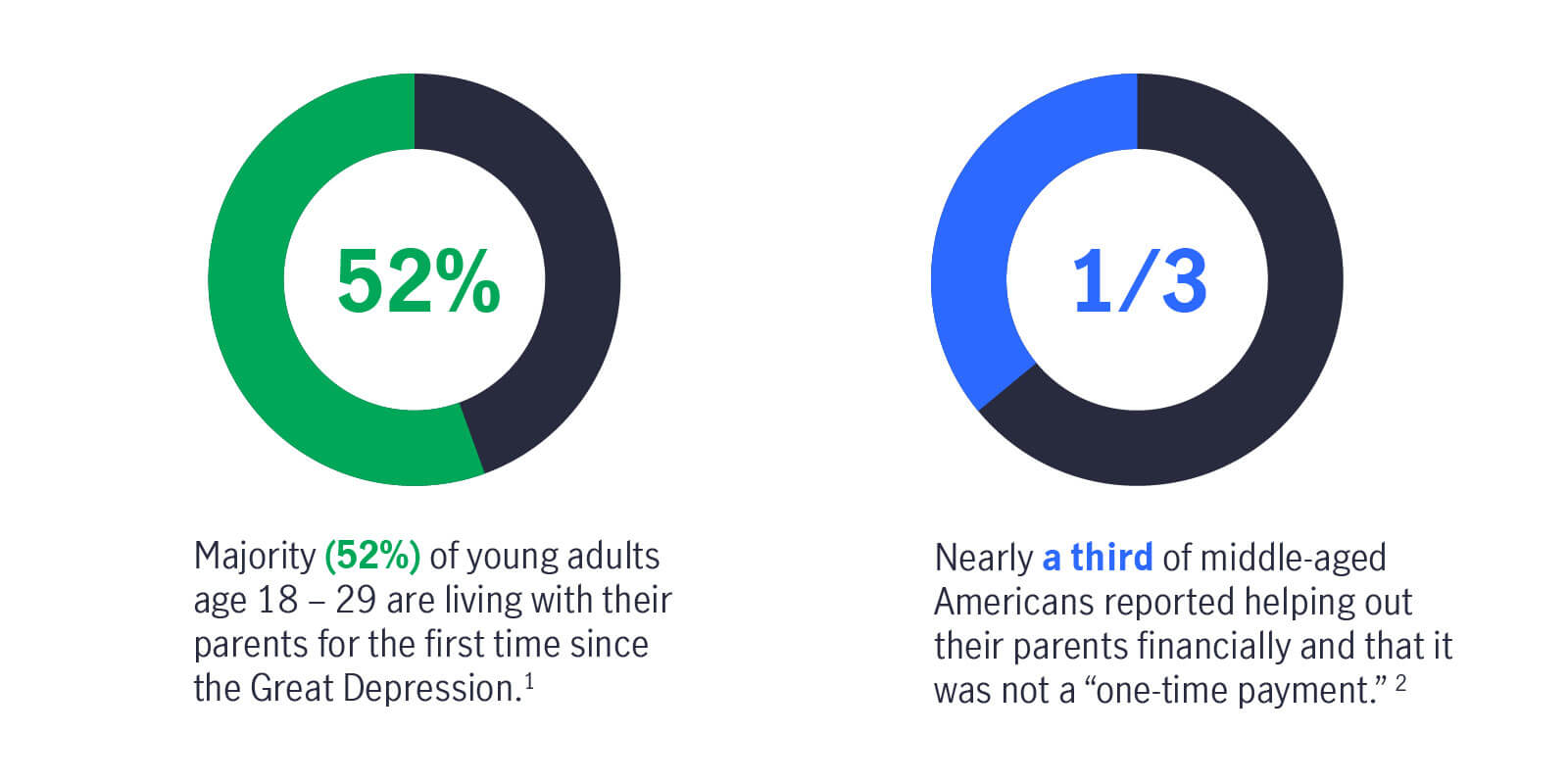

According to the Pew Research Center, a majority of young adults age 18 – 29 are living with their parents for the first time since the Great Depression.1 Much of this dramatic increase is directly related to the global pandemic of COVID-19 but even before it, there was a significant uptick cited of young adults moving back home after graduating from college and planning to stay well into their late 20s and 30s.

And then there’s your parents to consider. With people living longer than ever, is there a chance that they will become dependent upon your help financially, too? Or maybe even need to move in with you? A recent AARP Survey reported many “middle-aged Americans are struggling to save for retirement in part because they are saddled with taking care of their elderly parents.2 Nearly a third reported helping out their parents financially and that it was not a “one-time payment.”

This is what many call the classic Sandwich Generation scenario. It may be a situation where you find yourself actually needing more life insurance protection than you thought. Or protection for a longer period than you expected.

So how much do you really need now?

As mentioned earlier, at this stage in life many people consider scaling back their life insurance coverage. But if you’ve got adult children and/or your parents counting on you financially, you’ll want to take into account their needs before doing so. And remember, when you retire you’ll no longer have your employer-provided life insurance to factor in.

While term insurance is typically a less expensive option, protecting you for a set period of time and only paying a death benefit, other types of policies can potentially grow in cash value and provide you additional income. But no matter which type you choose, at John Hancock, they all come with Vitality. This innovative program rewards you for the simple things you do to live a longer, healthier life — like eating more fruits and vegetable, getting a good night’s sleep, even taking a walk.

Need help deciding what to do?

Sometimes the next best step is to talk with your family and friends. Find out how your peers are taking care of today’s financial needs while planning for and protecting tomorrow’s. Or better still, talk to a financial advisor. Someone who can help you choose the best option for you and your family.

John Hancock’s been helping people make the most of their financial opportunities for more than 157 years.

Citations

1 Pew Research Center: “A majority of young adults in the U.S. live with their parents for the first time since the Great Depression” by Richard Fry, Jeffrey S. Passel, & D’Vera Cohn, September 4, 2020 https://www.pewresearch.org/fact-tank/2020/09/04/a-majority-of-young-adults-in-the-u-s-live-with-their-parents-for-the-first-time-since-the-great-depression/

2 FOXBusiness: “Middle-aged Americans are bankrolling their parents, study finds” by Megan Henney, February 3, 2020 https://www.foxbusiness.com/money/middle-aged-americans-bankrolling-parents-study

Vitality is the provider of the John Hancock Vitality Program in connection with policies issued by John Hancock.

Insurance products are issued by: John Hancock Life Insurance Company (U.S.A.), Boston, MA 02116 (not licensed in New York) and John Hancock Life Insurance Company of New York, Valhalla, NY 10595.

MLINY121721567-15